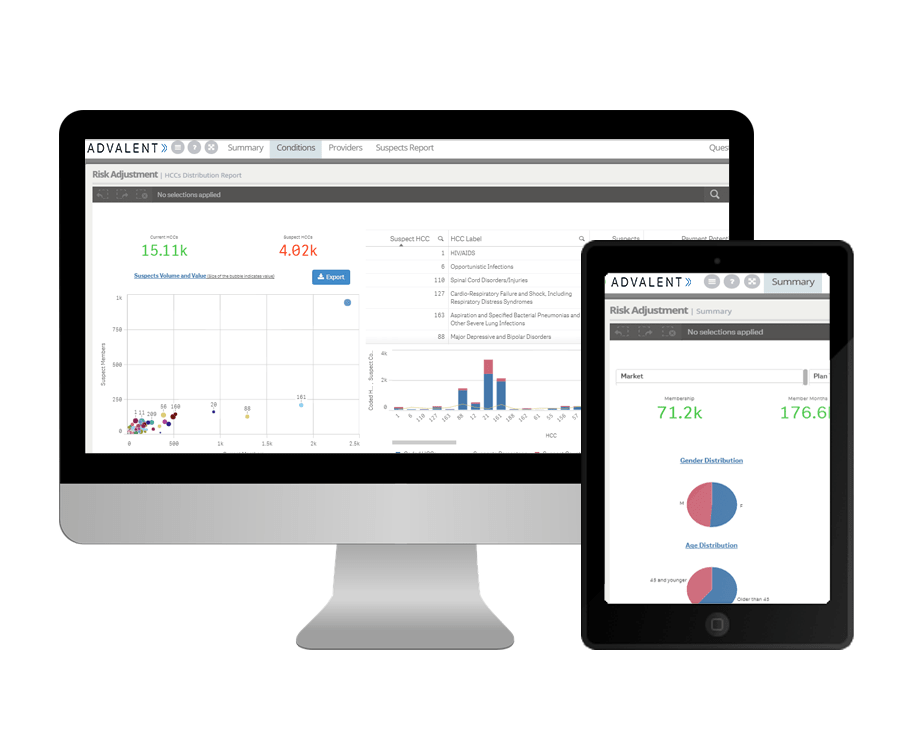

Risk360™ allows payers and risk-bearing providers to identify suspect conditions that are under-documented and that have gone undocumented. In addition, the platform assigns the right interventions for each HCC/RAF gap to address gaps considering their propensity of closure during the required coverage periods.

Risk360™

Reimbursement Improvement Solution

Understand complete disease profile and care patterns for every member

Analyze all available administrative and clinical datasets to assess the clinical profile of every member along with diagnosis and documentation gaps.

Improve both clinical and financial performance

Provide the right care to all members along while improving risk-adjusted reimbursement by integrating care/quality programs with Risk Adjustment.

Promote provider awareness and payer-provider collaboration

Generate sustainable clinical and financial improvements by engaging providers with the right programs (education, gap-closure etc.) at the point-of-care.

Track provider coding/documentation patterns across all lines of business

From under-coded to un-coded to un-assessed, identify all diagnosis (or HCC) gaps along with their payment improvement potential for all populations.

Deploy high-ROI operational activities to address HCC gaps

Continuously measure provider performance (as against the metrics and targets) during the benefit-years to offer proactive support

Advalent Risk360™ Features

Connect all available data sources through electronic data interchange services (both administrative and clinical) to assess complete clinical state of every member

Identify and prioritize suspect HCCs in addition to attributing them to providers for driving risk score improvement programs

Create actionable list of members and providers to drive risk score along with care and quality improvements

Identify provider contract optimization opportunities to enable value-based reimbursement and deploy the right provider collaboration programs

Out-of-the-box provider attribution and provider performance scoring algorithms along with an ability to configure plan-design characteristics

Benefits

GENERATE SUPERIOR ROI FROM YOUR RISK ADJUSTMENT PROGRAMS

Ensure high predictive accuracy by deploying hundreds of clinical algorithms which are converted into analytics by applying various advanced statistical methods.

ENABLE INTEGRATED RISK ADJUSTMENT, QUALITY AND POPULATION HEALTH PROGRAMS

Integrate quality/care gaps and potential adverse events (ER utilization, readmissions, preference sensitive treatments etc.) with RAF/HCC gaps and drive provider engagement to improve plan-level clinical and financial performance.

DRIVE SUSTAINABLE FINANCIAL IMPROVEMENTS

Significantly improve network efficiencies by leveraging top performers and supporting low-performing providers through varied provider collaboration strategies.

DEPLOY PROVIDER INCENTIVES/DISINCENTIVES

Proprietary analytical models enable decision makers to identify suitable value-based reimbursement strategies that improve risk-adjusted revenues.

ENHANCE COMPLETE FINANCIAL AND CLINICAL PERFORMANCE

Enhance provider performance by providing targeted recommendations via performance reports to drive continuous clinical and financial improvements.